From chaos to clarity: FP&A planning season unlocked

Planning is something every company does, but when it comes time to start the annual budgeting process, you’ll often hear some moaning and groaning. The reality is that many people dislike budgeting and consider it a waste of time. In the words of Bayer CEO Bill Anderson: “Budgets represent the worst of corporate bureaucracy.”

The truth of the matter is that—regardless of one’s opinion on the budgeting process—budgeting has traditionally been a labor-intensive, time-consuming process that leaves people frustrated. Many of the key issues that make the budgeting process so stressful include:

- Manual processes: Excel templates and files flying back and forth via disconnected spreadsheets

- Disconnected data: Much of your time is spent trying to gather data from disparate systems, and people often disagree over what the correct numbers are

- Game playing: Department leads play games with their budget system to improve potential bonuses for themselves and their team

- Lack of transparency: Finance creates the budget in a silo without involving the entire business

- Constantly changing numbers: Multiple versions exist with leadership, continually changing the numbers and targets

- Numbers obsolete before finished: The ink is barely dry before everyone realizes the budget numbers need to be changed

The case for change

The need for change is clear, and many organizations have implemented changes to enhance their budgeting and forecasting processes. However, a significant amount of work remains for most companies to achieve a connected, dynamic budgeting process that adapts to the business.

Many FP&A professionals and businesses learned valuable lessons about the importance of dynamic, connected planning during the COVID-19 pandemic. When COVID-19 hit, companies’ budgets became useless, and they suddenly found themselves building multiple scenarios and constantly trying to predict their cash flow. This was a wake-up for many companies and highlighted several of the key reasons companies should focus on creating a more modern connected planning process:

- Improved agility and responsiveness: The traditional budgeting process is often very ridged, locking companies into static plans. With today’s market changing more rapidly than ever, companies need an agile and responsive process that involves continuous connected planning throughout the organization.

- Enhanced cross-functional collaboration and alignment: A good budgeting process is an exercise in communication, communication, and then some more communication. Unfortunately, planning often struggles with departmental silos and a lack of alignment between the financial and operational plans.

- Real-time, data-driven decision making: Companies need to be able to see key data elements throughout the entire year and adjust accordingly. Building a plan based on one set of data that is often outdated before the plan is even final makes it difficult for the business to be successful.

- Better resource optimization and strategic focus: A connected planning process makes it easier for leadership to change resource allocation based on the latest data being provided vs always being told no that initiative cannot be funded because it wasn’t in the original budget.

How to bring clarity to the budgeting process

As we strive to bring clarity to the budgeting process, it’s essential to first be aware of the common pitfalls that can derail the best of intentions when it comes to budgeting. These pitfalls fall into three categories:

- Communication issues

- Lack of collaboration

- Data quality issues

Once your team understands the common budgeting pitfalls and has a plan to avoid them, the next step is to focus on quick wins—improvements that can be implemented right away to enhance the annual budgeting process.

These first two steps can be taken at any time and should be pursued while keeping the bigger picture in mind: building a continuous, connected planning process with dynamic updates throughout the year. Achieving this long-term vision typically requires significant changes to processes and systems, and it’s not something that can be accomplished overnight.

Three common pitfalls

The budgeting process often runs into three common types of pitfalls, as outlined above. In this section, we’ll take a closer look at each category and highlight what to watch out for.

1. Communication issues

In the words of Irish playwright George Bernard Shaw, “The single biggest problem in communication is the illusion that it has taken place.” In other words, one of the fastest ways to doom your budgeting process is through lack of communication.

Make sure you have a clear plan to communicate the process early to each of your department stakeholders and then schedule regular meetings to check-in with your stakeholders throughout the process. When you finish the budget, you never want to go into a meeting and hear someone say: “That is not my number,” or “I do not recognize that number, Finance must have made it up.”

If this happens, you clearly did not communicate well enough throughout the process. A close cousin to constant communication is collaboration.

2. Lack of collaboration

The budgeting process isn’t a math exercise; it’s a planning exercise. The goal of planning isn’t to hit the budget for next year. None of us have a crystal ball and, no matter how much time we spend planning, we will be wrong. The goal is to create a credible plan that will guide the business.

Garry Ridge, former CEO of WD-40, summed it up this way: “It looks like a roadmap to a destination that you know is not necessarily 100% correct, but directionally very, very concise and understandable.”

A robust planning process can only take place through collaboration across the entire business. This means working with other teams to understand their goals, priorities, and strategies—and then aligning those with the company’s overall strategic objectives.

3. Data quality issues

The third pitfall is data quality issues. I’ve seen entire plans go up in smoke because they were built on poor data. It’s not uncommon for companies to face million-dollar budgeting problems caused by misinterpreted data, incomplete information, or, in some cases, simply incorrect data.

Improving data quality takes time but recognizing it as a common challenge is the first step. This awareness allows you to put extra reviews and business conversations in place to catch issues early. I’ve experienced data quality issues firsthand. At one company, I was tasked with building a model for a new business unit. After six months, we had what looked like a solid model—but as we dug deeper into the data, I realized it couldn’t hold the business accountable to the plans and forecasts we were creating.

Nearly a year later, I rebuilt the model with cleaner, more accurate data. This version finally allowed us to have meaningful conversations with business partners at the product level. While it took a considerable amount of time to work through and correct the data, the effort paid off. The new model made the budgeting process far easier because it spoke the language of the business.

It didn’t fix every data problem, but it was a valuable reminder: real progress comes from tackling the biggest issues first and working through them systematically.

Understanding common pitfalls is an important foundation but now let’s shift to some quick wins that any company can implement to make the budgeting process smoother, regardless of the tools or technology they use.

Implementing quick wins

Below are five quick wins that can improve the budgeting process and put you on the path to long-term success.

- Target alignment: Many an FP&A professional has gone into the budgeting season without a clear understanding of what senior management expects, and this almost always results in a mess at the end when the budget presented isn’t aligned with management goals. Ensure that you have a conversation early and, at a minimum, align on high-level targets so that everyone is on the same page. This will save you a lot of time at the backend.

- Detailed calendar: The more thorough the calendar you build before starting the budget, the easier it will be to stay on target. Create a calendar for each step in the process, outlining the dates by which the business will receive files, the data submissions are due, and the deadline for Finance to complete its review. Make sure to build some buffer into the process because one thing is certain: it will not go exactly as planned. In addition to creating a detailed calendar, also build a checklist so you can validate you do not miss steps in the process.

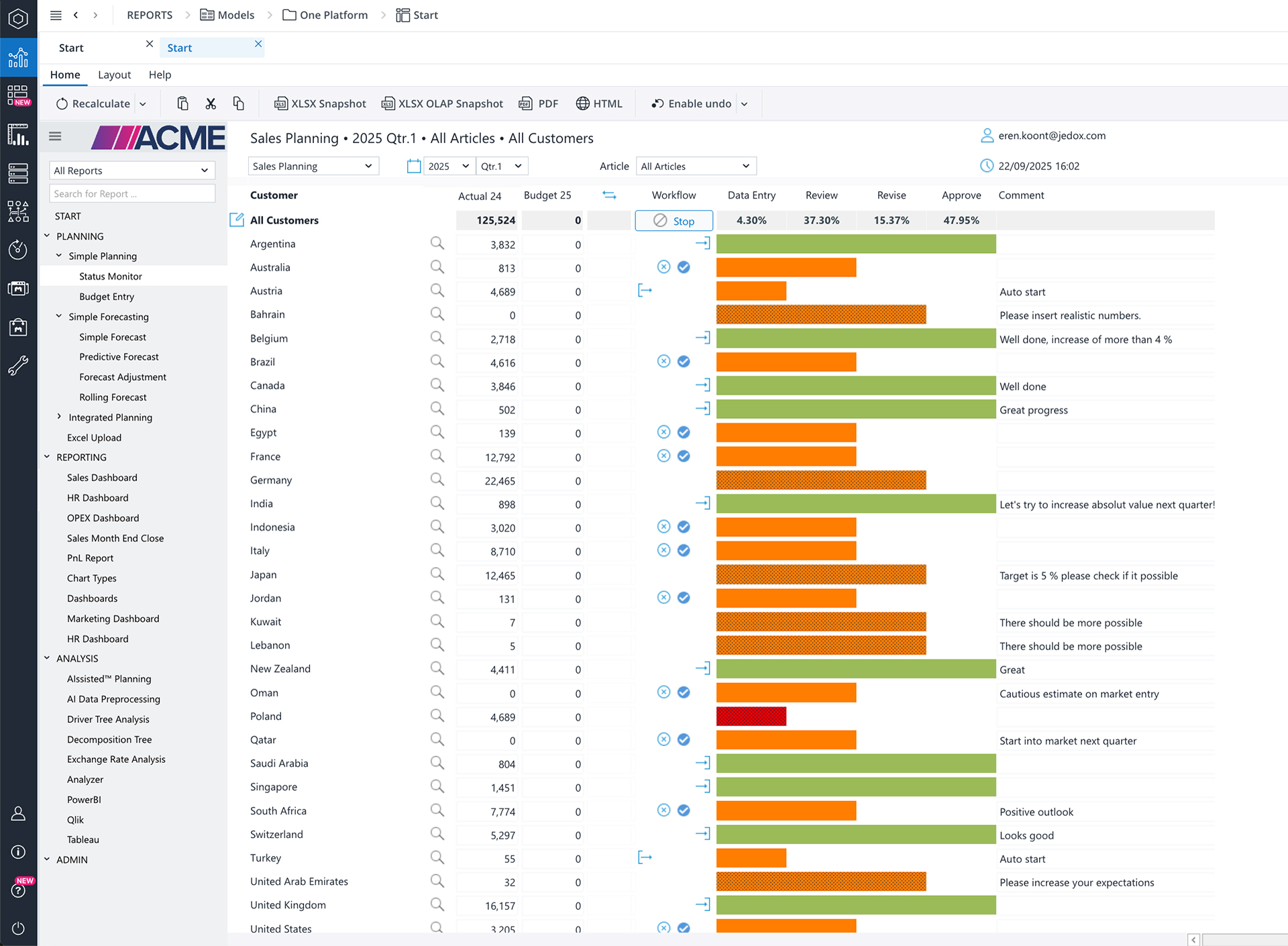

Jedox Workflows (modeling and collaboration) take your budgeting calendar and checklist to the next level. They provide a governed, transparent way to manage planning and reporting processes across the organization. With Workflows, you can assign tasks, responsibilities, and deadlines to the right people, track progress and approvals, and ensure every step of the cycle is traceable. By harmonizing Workflows across departments, Jedox not only strengthens collaboration but also boosts efficiency and ensures consistency and compliance throughout enterprise-wide planning.

Jedox Workflows (modeling and collaboration) take your budgeting calendar and checklist to the next level. They provide a governed, transparent way to manage planning and reporting processes across the organization. With Workflows, you can assign tasks, responsibilities, and deadlines to the right people, track progress and approvals, and ensure every step of the cycle is traceable. By harmonizing Workflows across departments, Jedox not only strengthens collaboration but also boosts efficiency and ensures consistency and compliance throughout enterprise-wide planning. - Simple templates: As Finance professionals, it’s in our nature to build templates that cover everything and that are often more complex than they need to be. The templates you use with your business should be built for understanding, collaboration, and ease of completion. Don’t include every detail in the template; forecast the immaterial stuff yourself and only ask the business to provide the information truly needed. This will win you points with the business as it makes their life easier.

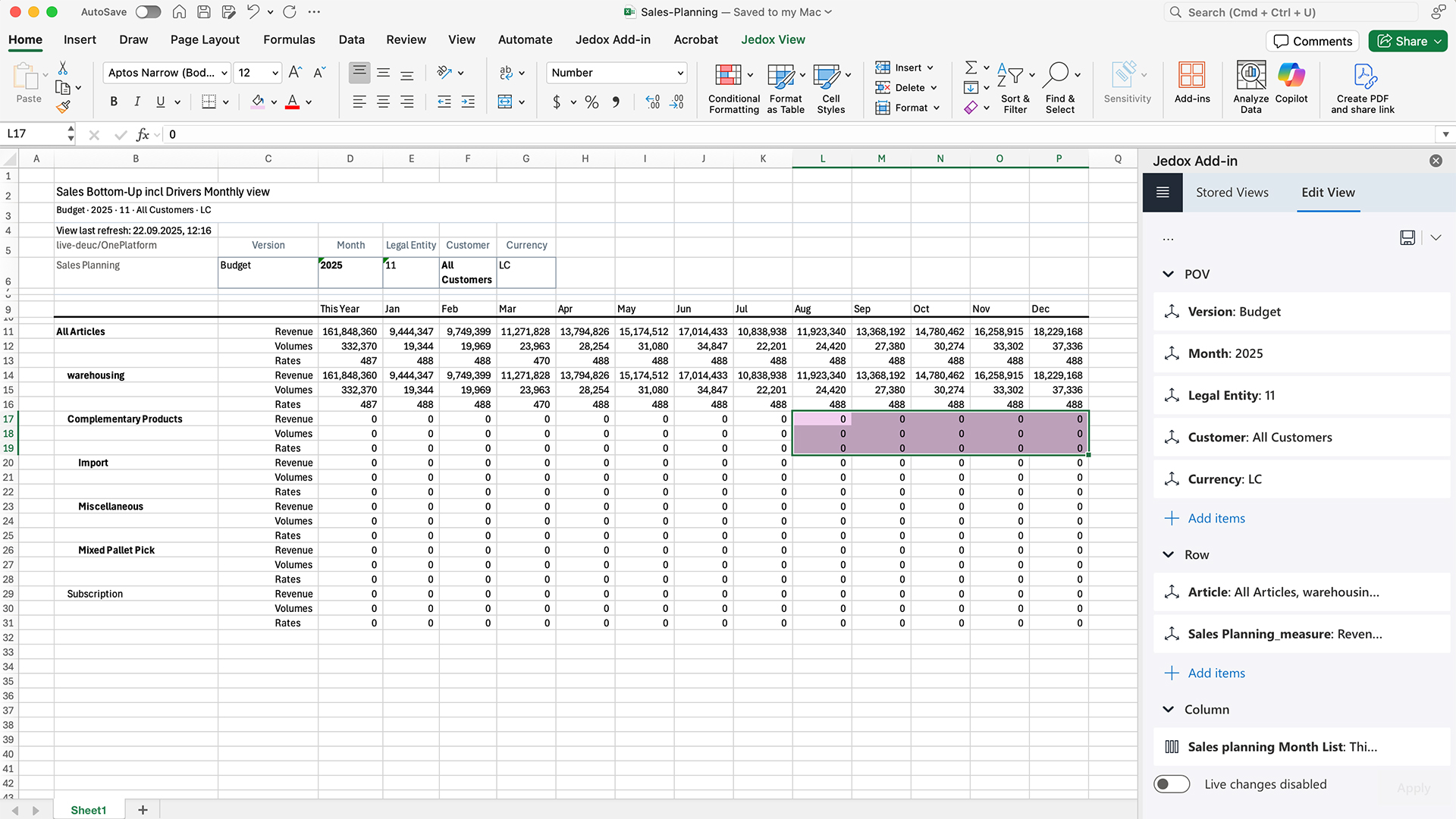

With the Jedox Excel Add-in for Microsoft 365, you can keep the simplicity of templates while connecting them directly to a unified planning platform. Users continue working in the familiar Excel environment but eliminate manual exports and benefit from a single source of truth across the organization. The add-in enables real-time planning, analysis, and reporting with full writeback capabilities—while allowing you to quickly build models in Jedox using existing Excel-based business logic. Plus, deployment is simple and secure: enterprise-wide planners and modelers can access the add-in on any desktop environment (Windows, Mac, or Web) through a centralized process.

With the Jedox Excel Add-in for Microsoft 365, you can keep the simplicity of templates while connecting them directly to a unified planning platform. Users continue working in the familiar Excel environment but eliminate manual exports and benefit from a single source of truth across the organization. The add-in enables real-time planning, analysis, and reporting with full writeback capabilities—while allowing you to quickly build models in Jedox using existing Excel-based business logic. Plus, deployment is simple and secure: enterprise-wide planners and modelers can access the add-in on any desktop environment (Windows, Mac, or Web) through a centralized process. - Focus on core data: Points three and four go hand in hand. Part of simple templates is focusing on core data. However, focusing on core data extends beyond templates and encompasses models, reports, and all activities undertaken during budgeting season. Most businesses, products, and departments have 3-5 key drivers that drive the business. Make sure you get the core elements right and that the data is as high-quality as possible for those material items. If your data is terrible but the expense is relatively small, then don’t spend much time on it, as it will not drive value for you or the business.

- Postmortem: If you’re in the middle of budget season, this is not a quick win but building it into your annual process can be a huge win. At the conclusion of every budget, while the experience is fresh in your mind, sit down with your team and develop a list of things you can do to improve the plan for next year and a plan of action to accomplish them over the next year before you restart the process.

I’m a big fan of number 5 because I’ve seen its benefits firsthand. When I was new to a role, a Senior Vice President told me, “Next year’s budgeting process will not be like this year’s. I’m not going to be up at 2 a.m. plugging in numbers.” He tasked me with meeting all the key business stakeholders, gathering feedback, and redesigning the process.

I spent the year working on this project, and when we completed the next budgeting cycle, several people personally told me how much smoother the process was. That experience reinforced an important lesson: always evaluate how a project went and use that reflection to create a plan for improvement next time.

The long-term vision

In the long run, best-in-class budgeting requires creating a clear vision of what it means for your company and mapping out the corresponding process. More likely than not, this will require upgrades to your data quality and the systems you use. When it comes to improving processes in the long run, I like to think of them in terms of three areas: People, processes, and platform.

- People: After you’ve clarified what your budgeting process should look like and your long-term vision for it, ask yourself if you have the right people. If you have the right people, ask yourself if they possess the necessary skill sets and training to achieve the vision. For example, let’s pretend your vision involves building predictive algorithms for forecasting. Do you have anyone on the team with the skills to implement predictive algorithms? If the answer is no, do you need to train the people, or will this be addressed through new technology? If you believe you don’t have the right people on board, then develop a plan to get the right people on board and provide them with the support and training they need to achieve the vision.

- Processes: Once you have a clear roadmap of where you’re going as it relates to budgeting, ask yourself what processes need to change. Map out the entire process from end-to-end and work with your team to improve the processes. This isn’t just a matter of improving processes, but also ensuring your team has a process-oriented mindset.

- Platform: No matter how great your team is or how focused they are on developing best-in-class processes, if the systems and tech they use are outdated and burdensome, you’ll be limiting your team’s effectiveness. Ask yourself what technology you need to support your ideal budgeting process. What would my planning platform need to be capable of to truly support the business and build the case for selecting and implementing a planning tool that will enable your team to reach its maximum potential?

Focusing on the 3 P’s as you build toward a long-term, sustainable best-in-class budgeting process is critical. Without a plan to address all three areas, you are setting yourself up for failure.

Conclusion

Although most people seem to dislike the budgeting process and complain about what an unpleasant experience it can be, it doesn’t have to be that way. The annual budgeting process is an opportunity to improve your planning across the company. Regardless of the method you choose, the tips laid out in this article will help you enhance your process from start to finish.

By applying best practices and quick wins in the short term, while building a sustainable long-term process, you can transform your budgeting from chaos to clarity. And if you’d like to explore this topic in even more detail, you can check out my recent webinar on the subject with Jedox’s Rohan Kapil.