Navigate ESG reporting and use the reports for strategic business planning

With legal regulations such as the European Sustainability Reporting Standards (ESRS), coming into effect on January 1st, 2024, organizations are required to implement standards for their ESG reporting. Typically, it is finance teams who are best suited to oversee putting ESG reporting into practice. To do so successfully, ESG data management and the successful implementation of the organization’s ESG strategy must be navigated. ESG considerations and practices must be embraced; after all, falling short under public scrutiny can easily result in reputational damage, and merely the perception of greenwashing can jeopardize sustainability efforts long-term.

Automated data integration for a single source of truth

Getting all the necessary data is crucial. Benefit from Jedox powerful integration capabilities to easily connect to HR systems, ERP systems, and travel management systems and get data for your ESG reports from one proven platform.

Flexible ESG reports with models built in-house

ESG reporting is as unique as organizations themselves. Use the flexibility Jedox provides to customize it – by adapting existing models for ESG by your own staff on a granularity level they determine.

Master the most complex demands

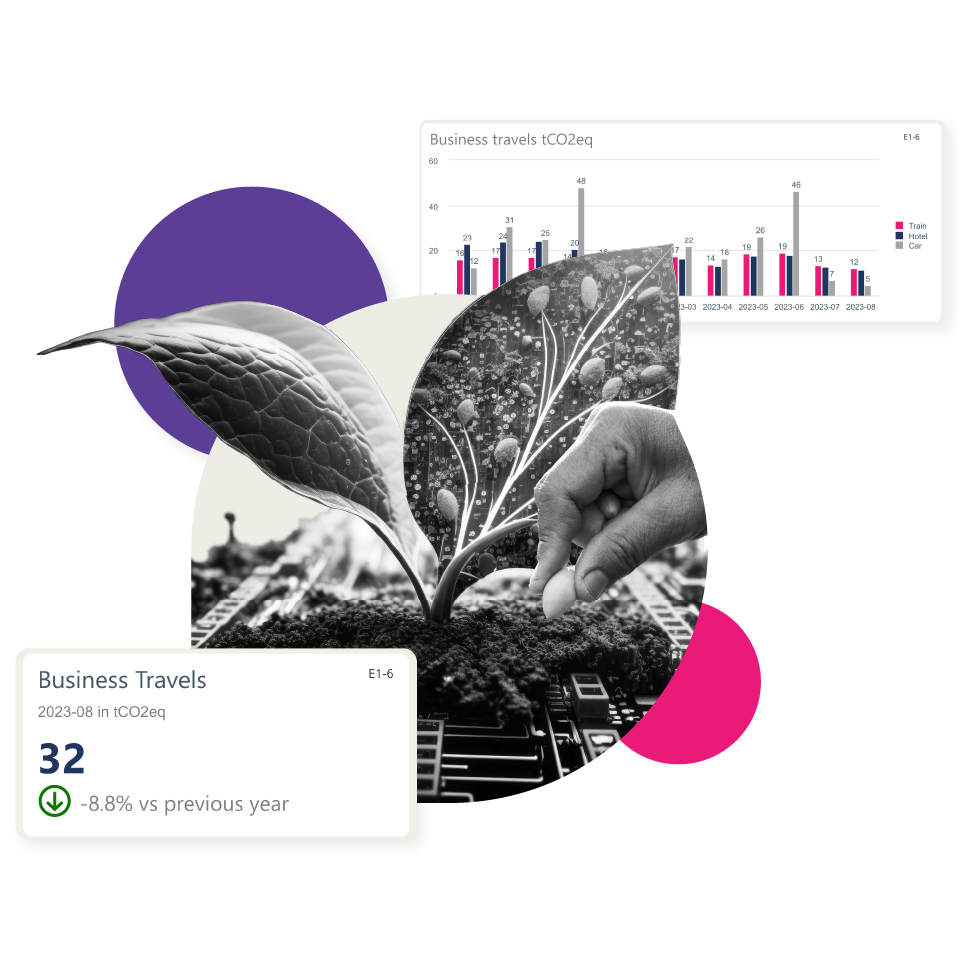

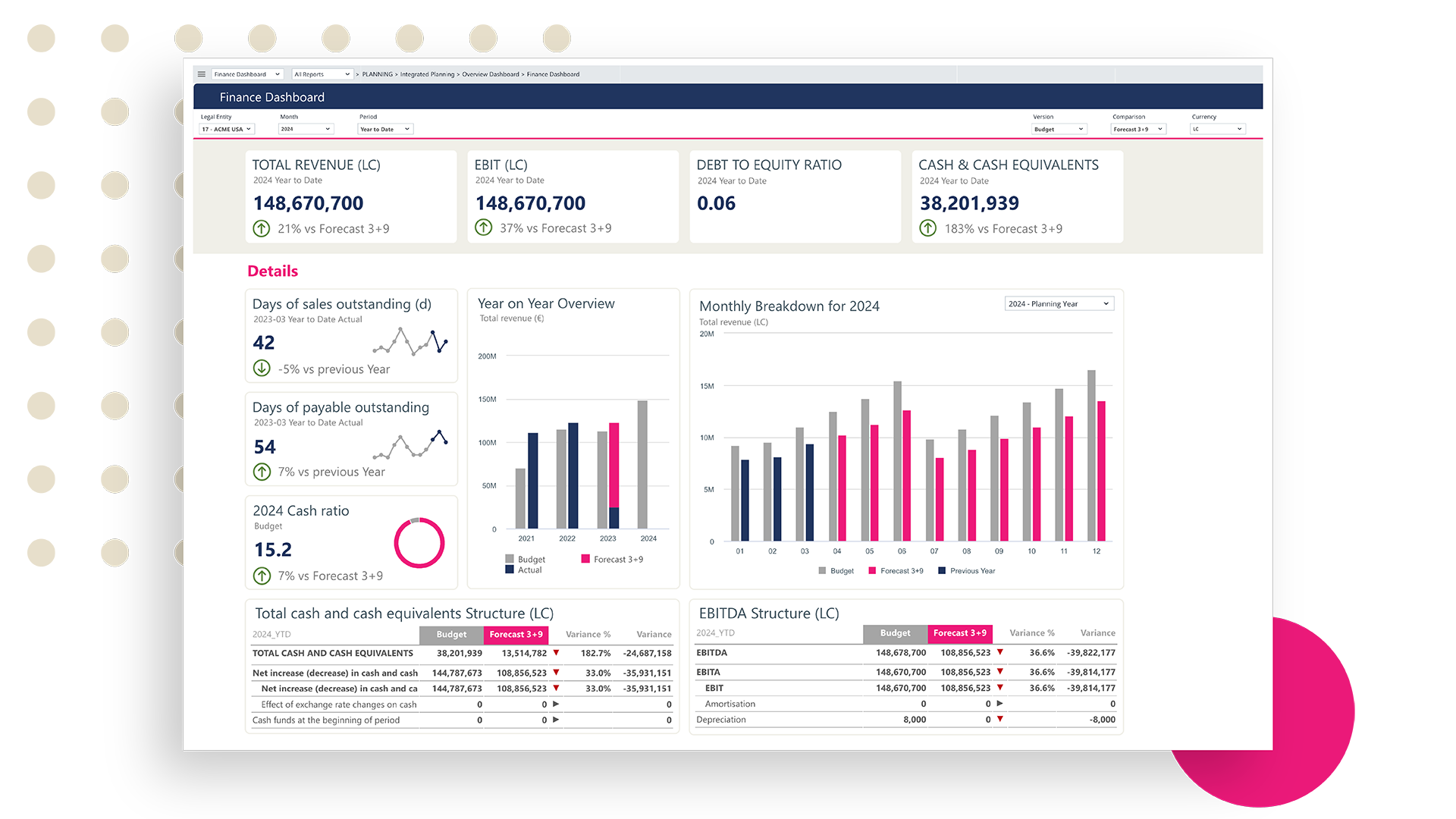

Jedox automatically collects and reports data, from any source, using the out-of-the-box Best Practice Accelerator. It comes with an ESG dashboard and is a fast way to get started with ESG compliance and easy data-access for XBRL export generation. Data can be quickly analyzed and individually filtered through all legal entities, and it is possible to easily drill down to individual months or to compare budgets to actuals.

ESG strategy for long-term goals

Jedox enables setting long-term targets, creating and managing initiatives, and doing what-if scenario planning of those initiatives, including projecting those into the integrated P&L and cash flow for strategy planning.

What it’s like to work with Jedox

Organizations of all sizes trust Jedox to model any scenario, integrate data from any source, and simplify cross-organizational plans.