The impact of AI on financial forecasting and budgeting

As traditional budgeting methods fall short, modern CFOs are pivoting towards advanced tools and technologies to stay competitive in a volatile and unpredictable landscape.

In this article, we’ll explore the role of AI in budgeting and forecasting. Discover how AI tools equip financial planning & analysis (FP&A) teams with the critical insights needed to guide their companies through challenging times and maintain a competitive edge.

What is AI in financial forecasting and budgeting?

Artificial intelligence (AI) in finance refers to the use of AI technologies to enhance and automate traditional financial tasks. AI revolutionizes financial operations by automating repetitive processes and providing real-time recommendations—thus improving how businesses analyze, manage, and invest capital.

AI for finance professionals and CFOs delivers substantial business value by streamlining processes and shifting the focus from data collection to strategic oversight.

AI, including natural language processing (NLP) and machine learning (ML), are key elements driving the success of autonomous finance.

Here are key examples of AI applications in finance:

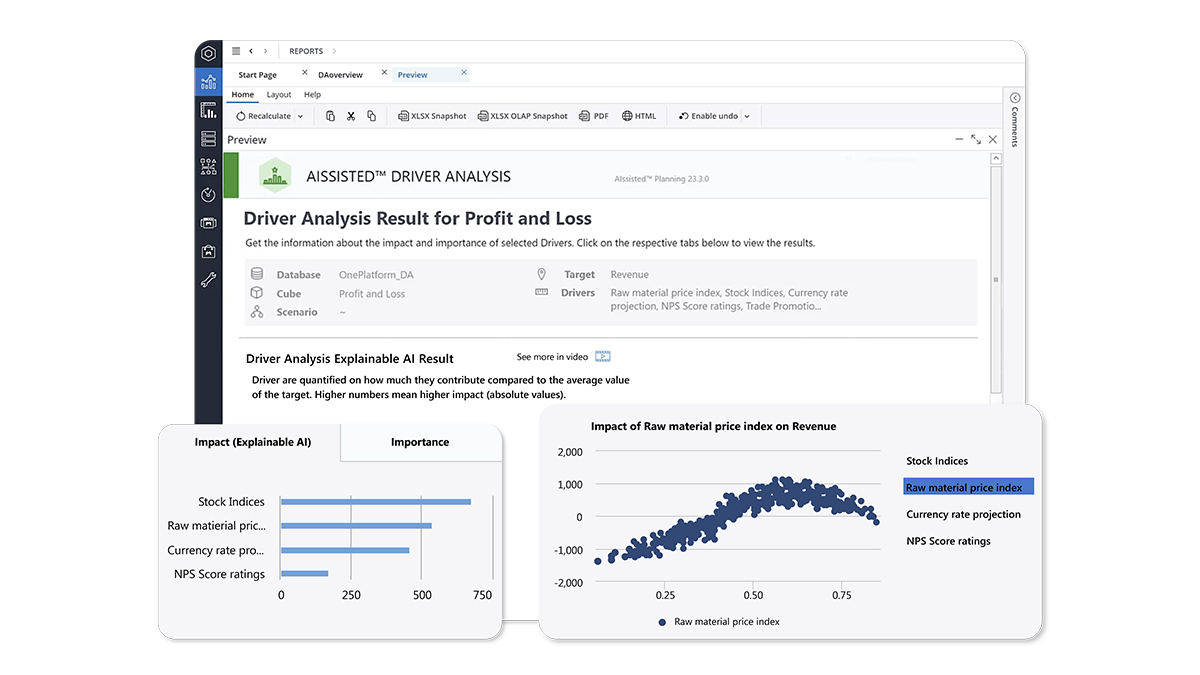

- AI in financial forecasting: Used to predict future financial results by analyzing past data based on key drivers determined by the Finance team. AI-enabled forecasting learns and adapts, enhancing accuracy as more data is analyzed. This is particularly valuable in the rapidly changing finance industry.

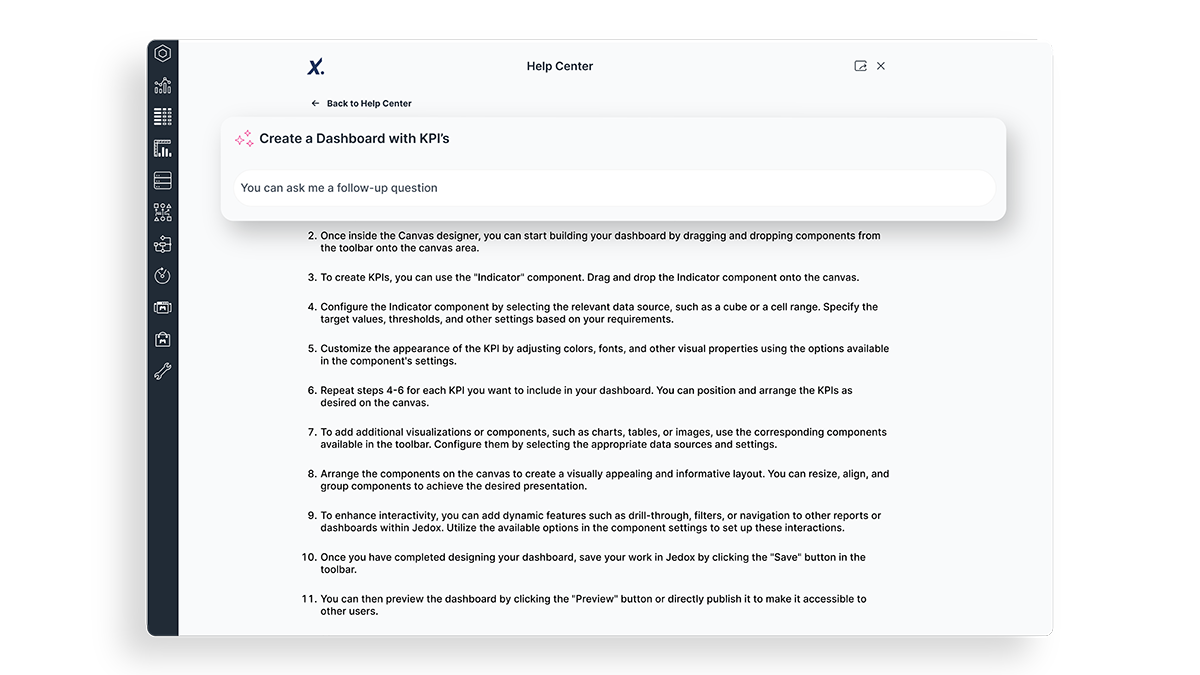

- Advanced reporting with NLP: AI redefines financial reporting by acting as an extension of your FP&A team. It uses natural language to collect data, generate reports, analyze trends, optimize forecasts, and answer complex business questions. It can be tailored to your unique business needs and becomes smarter over time as it learns more about your organization.

- ML for identifying financial trends: About 70% of financial companies use ML to improve their ability to predict and analyze data. ML, a branch of AI, relies on data and self-modifying methods to identify patterns and make predictions. It continuously refines itself for improved future outcomes. This aids in assessing and managing financial risk by predicting potential losses and identifying risk factors, allowing institutions to take proactive measures.

The benefits of AI in financial forecasting

In an era characterized by rapid change and unpredictability, the ability to forecast accurately and efficiently has never been more critical for businesses. AI in financial forecasting provides tools and methods that enhance precision, speed, and strategic planning. Below are several significant advantages that AI offers:

Improved accuracy

The introduction of AI in financial forecasting has set a new standard for accuracy by significantly reducing errors through the use of real-time data, pattern recognition, and trend predictions.

IBM research indicates that half of the businesses employing AI in budgeting and forecasting have managed to cut their overall error by at least 20%. Additionally, 25% of these companies achieved a reduction of at least 50%.

Speed and efficiency

The pace at which AI processes information grants Finance teams the ability to make swift decisions. AI’s capability to handle large datasets and identify complex patterns at speeds unmatched by human analysts saves significant time and resources.

By rapidly pinpointing anomalies and predicting future outcomes, AI not only accelerates the forecasting process but also enhances the quality of insights delivered to decision-makers. This enables them to act with greater confidence and agility.

Performant scenario planning

Traditional scenario planning, often sidelined due to its resource-intensive nature, is undergoing a transformation with AI. AI-driven scenario planning allows finance professionals to explore multiple potential futures, assessing a range of outcomes from best-case to worst-case scenarios.

AI in budgeting and forecasting enables a more collaborative approach to scenario planning. By integrating data across sales, operations, finance, HR, and other business units, AI tools facilitate the creation of comprehensive scenarios that reflect the diverse realities of each department.

This inclusivity ensures a holistic view of potential trajectories, empowering businesses to stress test their strategies and monitor key indicators for various outcomes.

The role of AI in budgeting and planning

Effective budgeting and planning are essential for sound financial management, and AI offers versatile solutions to overcome the limitations of traditional budgeting methods. Here is how:

Enhanced budgeting accuracy

Conventional budgeting and planning methods often prove to be time-intensive, rigid, and susceptible to errors—particularly when unexpected market shifts or disruptions occur. The use of AI in budgeting and forecasting offers significant benefits in terms of improving accuracy and efficiency.

AI algorithms can evaluate a broad spectrum of variables and data sources—such as economic indicators, market trends, and organizational metrics—to produce more accurate financial forecasts. This capability not only minimizes the chances of forecasting inaccuracies but also helps organizations anticipate potential risks.

Dynamic budgeting

Traditional budgets often become obsolete soon after they’re created, leading departments to chase outdated financial goals. AI transforms this process by enabling real-time budget adjustments that adapt to evolving business conditions, offering agility beyond traditional methods.

Machine learning models deliver immediate access to rolling forecasts, ensuring financial strategies remain relevant and provide value to the organization.

Better resource allocation

AI-powered algorithms enhance resource distribution by evaluating performance indicators, market trends, expenditure habits, and organizational goals. Finance leaders can utilize AI to pinpoint inefficiencies, improve resource distribution, and refine investment strategies.

By aligning resource allocation with strategic goals, CFOs can enhance return on investment (ROI) and foster sustainable growth.

Streamlined collaboration and communication

AI platforms with workflow automation enhance how departments share information, provide feedback, and make decisions in real-time—promoting greater transparency and accountability. These tools empower Finance teams to become more self-sufficient, improving collaboration and facilitating activities like business partnering.

By providing real-time access to financial insights and forecasts, AI platforms help dismantle data silos, enabling a more integrated approach to business planning. This ensures that strategic decisions are informed by a comprehensive understanding of the company’s financial health, aligning all departments towards common goals with clarity and coherence.

Challenges of implementing AI in finance

Incorporating AI into financial operations presents a unique set of challenges and considerations. Here are the main concerns businesses should address to ensure successful implementation.

Data quality: The effectiveness of AI is closely tied to the quality of the data it receives. Inadequate data management can result in unreliable forecasts.

To fully capitalize on AI’s capabilities, businesses need to develop strong data management systems and unify all relevant information into a single source of truth (SSOT). This approach provides AI tools with the comprehensive context required to produce accurate and actionable forecasts.

Data safety: Trust in AI systems is paramount, particularly concerning the privacy and security of business data and intellectual property. Implementing robust security measures is essential to protect sensitive information and build trust in AI applications. As discussions around future compliance laws evolve, ensuring data security will be crucial to maintaining confidence in AI-driven financial processes.

Implementation costs: Implementing AI in budgeting and forecasting comes with significant upfront costs, including the need for advanced software, hardware like powerful GPUs, and a robust infrastructure to support complex AI capabilities. These investments are necessary for managing large datasets and developing sophisticated algorithms.

Skill gaps: While AI has the potential to achieve forecast errors of less than 5%, reaching this level of accuracy requires both time and specialized expertise. Businesses must understand that immediate precision isn’t feasible without building robust capabilities.

FP&A practitioners and finance leaders need to actively engage with AI, challenging its recommendations and understanding the underlying factors driving these forecasts. Integrating AI in financial forecasting requires a workforce skilled in data science, machine learning, and software engineering, but a global shortage of AI talent complicates recruitment.

To bridge the gap between traditional finance skills and AI expertise, organizations must invest in training and upskilling to enable effective collaboration with AI technologies.

Embracing the AI revolution in financial forecasting and budgeting

AI for finance professionals is not just a trend; it’s reshaping every corner of finance, providing finance professionals with unprecedented opportunities for strategic advantage and efficiency.

Yet, navigating AI’s complexities can be challenging, highlighting the need for an innovative partner to ensure a successful implementation and maximize benefits.

Jedox stands at the forefront of this transformation, offering cutting-edge solutions that make FP&A effortlessly accessible. The latest Jedox 2024 Autumn Major Upgrade is a commitment to innovation, delivering enhancements powered by JedoxAI that simplify complex financial processes and empower organizations to leverage AI effectively.