Redefining financial reporting through automation, analytics, and AI

Financial reports — income statements, balance sheets, and cash flow statements — are crucial for organizations because they offer a holistic picture of the financial performance and health of the business. They are intended to provide factual, relevant, insightful and comparable information, which internal and external stakeholders can use to inform future decision making. It is crucial that these reports are accurate and complete otherwise the consequences could be disastrous: poor decision making, missed opportunities, regulatory compliance failures, economic losses, eroded trust, and reputational damage.

Though an organization’s financial planning and analysis (FP&A) team is typically tasked with preparing the all-important financial reports, the team’s role in recent times has widened to provide greater business insight, such as: monitoring key performance indicators and analyzing trends; improving budgeting and forecasting as well as financial projections; and developing financial models to validate strategies.

It is no surprise then that FP&A teams are increasingly automating financial reports — a typically labor-intensive effort prone to human error — leading to benefits such as greater accuracy, increased time savings and enhanced productivity. These teams face significant challenges such as ensuring data quality and accuracy culled from disparate systems of the organization and an ever-rising mountain of financial information. Automation, analytics, AI, data visualization, among other technologies, will help broaden an FP&A teams’ capabilities and skill sets: to manage scalability of an organization as it grows in size and complexity; drive deeper insight into data that results in usable, actionable information; deliver information in easy-to-understand and digestible presentations in real-time. For FP&A and top executives, technology is a business necessity to not only achieve and maintain a competitive edge in their industries, but also to comply with regulatory requirements, such as generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS).

What is financial reporting?

Financial reporting is simply the process of an organization presenting its financial performance and position to external stakeholders, such as investors, creditors and government regulators. It involves creating various reports — primarily income statements, balance sheets and cash flow statements — that provide transparency and insight into an organization’s financial health, position and trajectory. These three statements taken together can offer a picture to organizations of the road already traveled and future roads ahead.

In other words, they give FP&A and management teams the tools to track metrics, budgets and, ultimately, performance so they can see if the business is aligned to the overall mission and strategy. Investors and creditors use these records to gauge an organization’s overall financial well-being, strength and underlying business value. Regulators use these records to ensure businesses are complying with required standards and are playing by the rules, being upfront with their investors and customers, and identifying and correcting financial problems that may pose a risk to an organization.

What are the different types of financial reports?

There are three primary types of financial reports: income statements, balance sheets and cash flow statements. But organizations often also create statements of change in shareholder equity and notes to financial statements. Organizations may also create numerous other reports that are used internally by different departments, as well.

Income statement

Also referred to as a profit and loss (P&L) statement, this report offers an overview of expenses, revenue, profit/losses, net income, and earnings per share during a set period, typically a fiscal year or quarter. It is generally considered an organization’s most important financial statement because it shows the bottom line: net earnings and losses resulting from various business activities that can be compared over time to spot trends. For investors and others, these reports can show whether revenue is increasing and if expenses are being managed well.

Balance Sheet

This report essentially shows an organization’s net worth and, more importantly, a snapshot of its financial health as of a specific date. A balance sheet details assets (accounts receivables; liquid assets; inventory; property, facilities and equipment; and investments), liabilities (accounts payable; dividends payable; wages; notes payable and long-term debt) and its shareholders’ equity, which is total assets minus total liabilities since inception.

Cash flow statement

The cash flow statement shows how much cash an organization has taken in and how much it has spent on operational expenses, financing and investments — all its financial activities — over a certain period. This report provides a better picture of how well an organization can pay short-term bills as well as fund future growth.

Other important reports

- Statement of Changes in Shareholder Equity. Also known as the statement of retained earnings or stockholder’s equity, this report tracks total equity over a given time — that is an organization’s total assets minus total liabilities. It shows the total amount of money that would be returned to shareholders if an organization’s assets were liquidated and all debt paid off.

- Note to Financial Statements. Additionally, the IFRS requires some organizations to provide the Note (or Footnotes) to Financial Statements, which is intended to communicate context around the information provided in the other financial reports, such as assumptions used to prepare the figures as well as explain accounting policies.

What are the benefits of financial reporting?

Whether for internal or external stakeholders, financial reports must be correct, transparent and reliable. They are a snapshot of an organization’s financial health over a certain period, providing a lens into business operations, profit, loss, expenses, cash flow and other vital information. But why are they important and what benefit do they provide?

Measuring performance

Financial reports document the details of an organization’s operations, investments, debts, income and other data and how they affect the bottom line. FP&A, managers and executives can learn a lot of how well they’re spending money and whether they’re getting bang for the buck.

Making informed decisions

With the knowledge of their financial health over a period of time, organizations can make better decisions about their growth profitability, activities and future. They’re able to better evaluate strengths and weaknesses across the enterprise, allowing them to move forward with well-informed, strategic decisions about investments and any operational changes, potentially increasing efficiency and performance. Think more cost savings, better resource allocation and improved forecasts.

Maximizing confidence

As organizations show a commitment to providing regular, clear and correct information and insight into their cash flow, debts and profitability and other relevant financial data, it could boost the confidence—and enhance relationships—with investors, business partners, creditors, suppliers and even customers. It potentially means attracting more investment, building new partnerships and expanding the business.

Complying with regulations

It is a legal requirement for publicly traded organizations to provide correct financial reporting and follow certain fiscal reporting formats such as generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS). Private companies, too, must report financial statements to regulators and others. Failure to do so can lead to fines, legal issues and damage to their reputation.

Detecting fraud

Organizations can also find inaccuracies and inconsistencies through their financial reports, raising flags about potential fraud and thereby allowing executives to take action to mitigate damage.

Why invest in financial reporting software?

While financial reports largely look back at an organization’s financial performance and stability—holding a mirror to where a business has been and how well it is doing—they also serve as a signpost to investors and others, signaling whether the business is healthy and worth funding. The bottom line is that without accurate financial reporting any business will lose money and eventually cease to exist. But preparing financial reports is complex—especially for a large enterprise. FP&A personnel are often under considerable strain from top management and regulators to prepare them quickly, efficiently and precisely. Today, with intense competition across every industry, financial reports needn’t be a headache or burden. Investing in advanced software for financial reporting can yield several benefits. It is nothing short of a digital finance transformation of the enterprise.

Automation

Autonomous finance integrates artificial intelligence (AI), natural language processing and machine learning to automate the processes and operations embedded in financial reporting, which is repetitive, time-consuming and error-prone. An automated process can dramatically cut down on human error, which comes with collecting, processing and reporting the data, as well as ensure data integrity and quality from the sources. This offers a comprehensive view of data across departments, functions and lines of business, or a “single source of truth.”

Time management

While financial reports are a necessary part of a business, it is time-consuming and tedious for those tasked with the effort. Technology can speed up the preparation and dissemination of reports in a fraction of the time that it has typically taken. FP&A teams can better focus their efforts and skills to perform analyses, modeling and forecasting. Meanwhile, decision-makers can quickly obtain and view actionable information rather than outdated and/or irrelevant information. The bottom line is that an organization is working more effectively in a more collaborative manner.

Predictive analytics

Using data analysis to forecast financial trends, organizations are armed with better insight into cash flow forecasting, investments and risk management as well as the ability to create models for multiple scenarios.

Visualization

Sharing financial reports through dynamic presentations can help decision-makers quickly grasp an overview and details of their organization’s finances: where they’ve been and where they’re going. In short, it can help anyone — not just those with an accounting, finance and business background — better understand trends and patterns that might not be apparent otherwise.

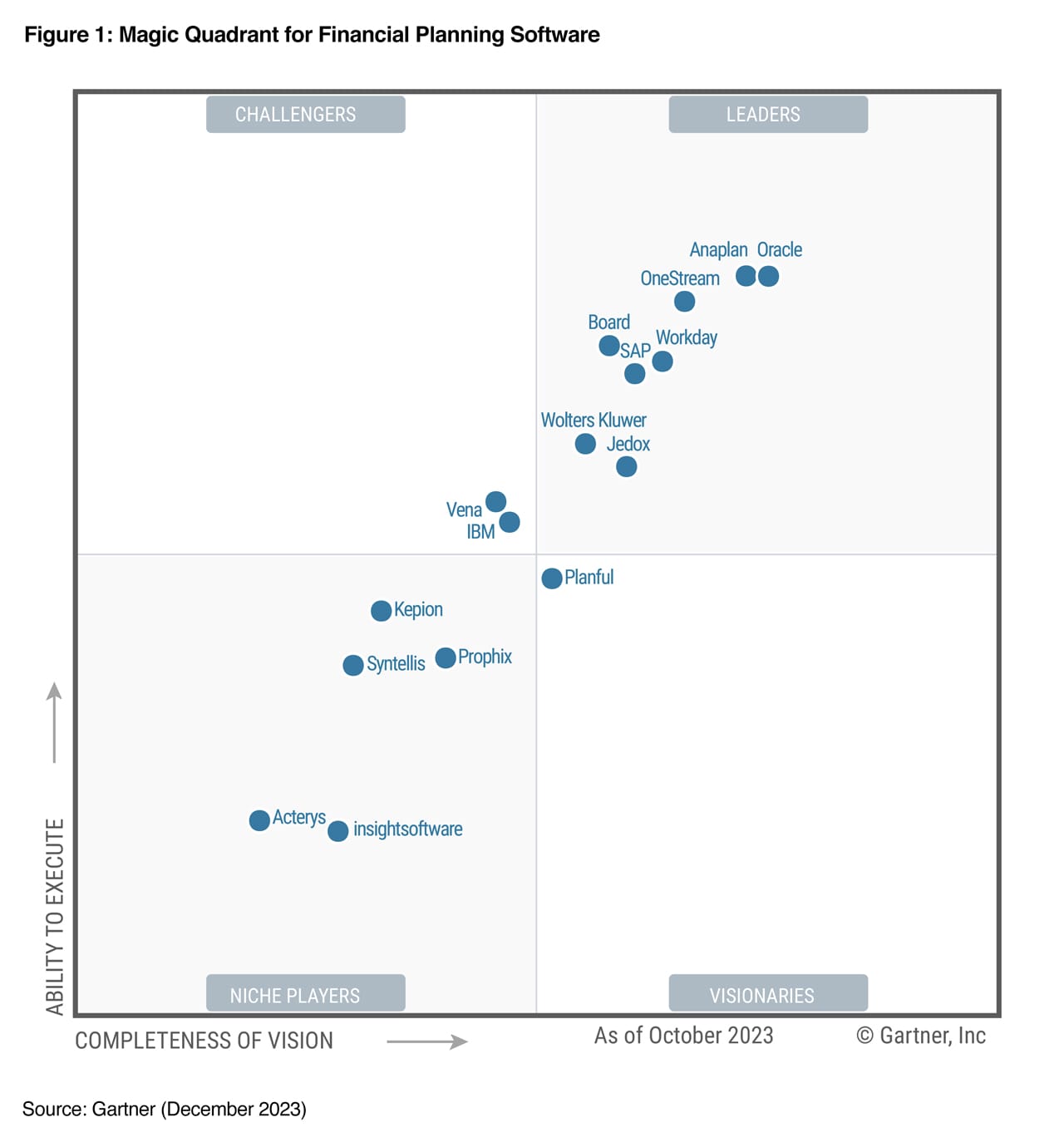

How Jedox software helps with financial reporting

FP&A professionals today expect automation, adaptability and ease of use through technology. There are plenty of choices in financial reporting software but not all are the same. Jedox’s financial reporting software provides faster reaction time, optimal adaptability for reporting structures and the needed consolidation, integration and visualization of financial data that provide the entire picture of an organization’s financial operations and health.

Jedox’s software automatically collates and cleans data while ensuring that reports adhere to compliance standards such as GAAP and the IFRS, greatly accelerating the time and efficiency it takes to create and view a report.

Speed

Jedox offers preconfigured templates for all standard reports, which means financial reporting requirements have been met and all that is needed is an organization’s data and information to fill in the rest. Moreover, those reports are customizable to an organization’s particular requirements.

Adaptability

Jedox allows the creation of ad-hoc or custom reports depending on an organization’s specific requirements. In a snap, organizations can create reports addressing market-related changes or based on other activities. The software can be integrated with a various applications and third-party tools along with Jedox’s own AIssisted™ Planning, which boasts AI and machine learning capabilities that support planning and analysis.

Integration

Jedox provides an integrated financial reporting, planning, and analysis platform that offers seamless consolidation and visualization of financial data in real time. This means the entire organization gets the full financial picture.

Intuitiveness

Jedox’s user interface is intuitive, which means anyone can get started quickly and easily without the need to learn coding. This empowers professionals across the organization to create their own reports directly from a single source of truth.