Intelligent financial consolidation for streamlined Finance

Built on the powerful Jedox platform, and powered by JedoxAI, the Jedox financial consolidation solution overcomes challenges to an efficient consolidation process—including inherent complexity of group structures, disconnected data, and manual process. Seamless Excel integration, easy to implement logic and rules, and audit trails let Finance teams cut manual effort, speed up close cycles, and gain the transparency needed for more strategic decision-making.

The solution leverages Jedox platform capabilities including AI predictive analytics, natural language processing (NLP), scenario modeling, and Jedox Integrator ETL integration with SAP, Oracle, Microsoft, BI tools, Google Sheets, and Excel ensure Finance teams can analyze, validate, and report with confidence.

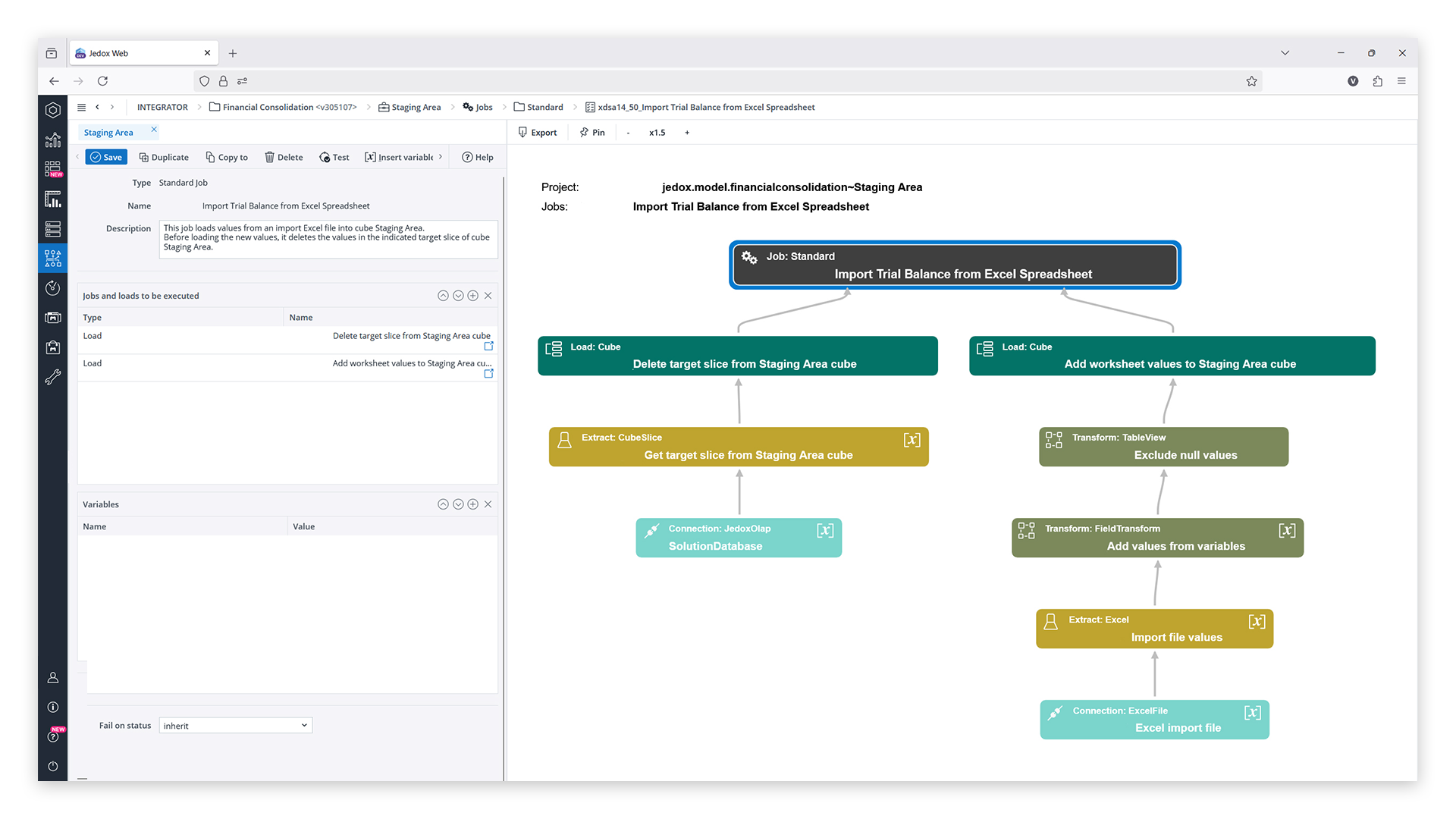

Integrated and automated your consolidation needs

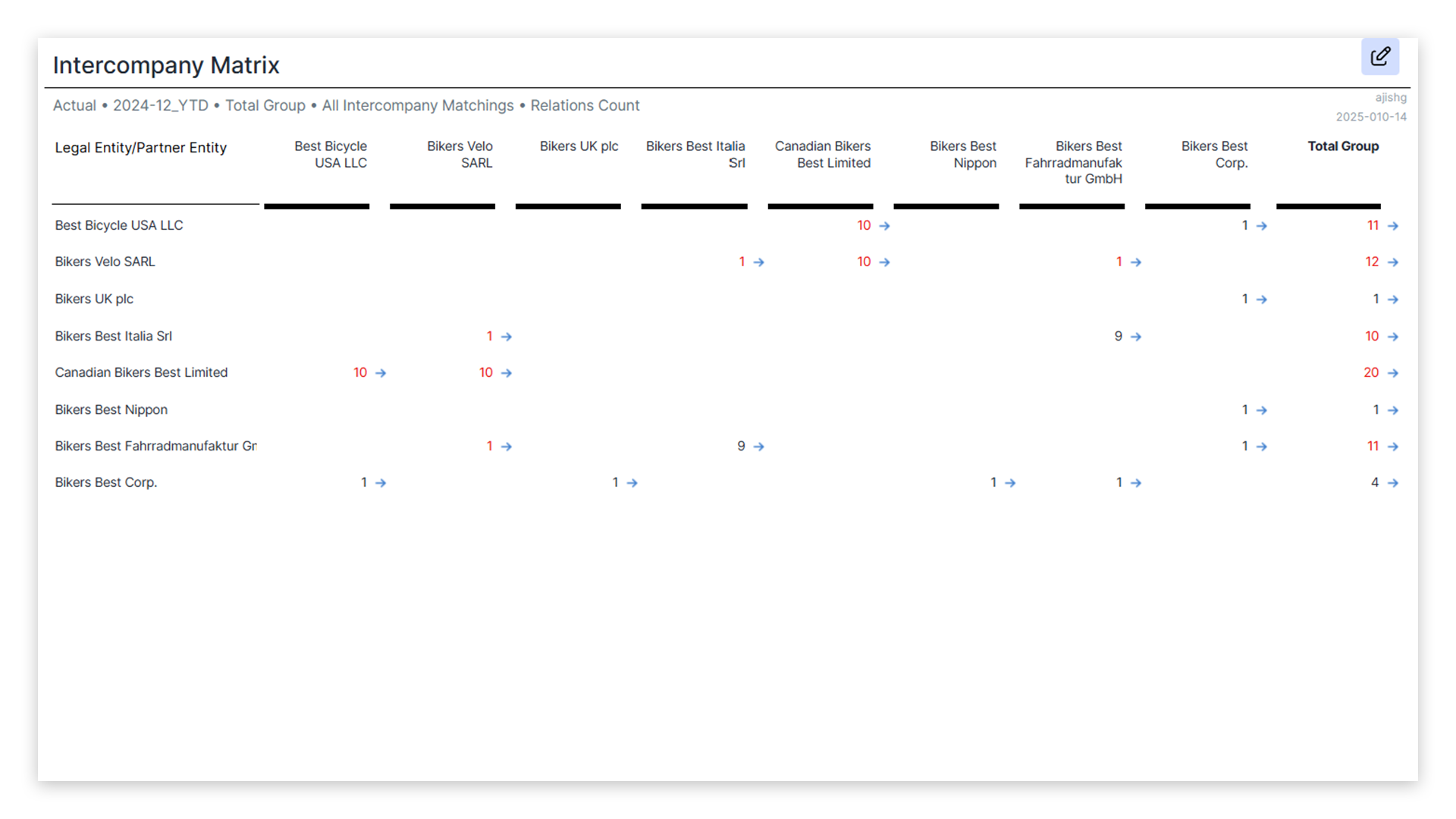

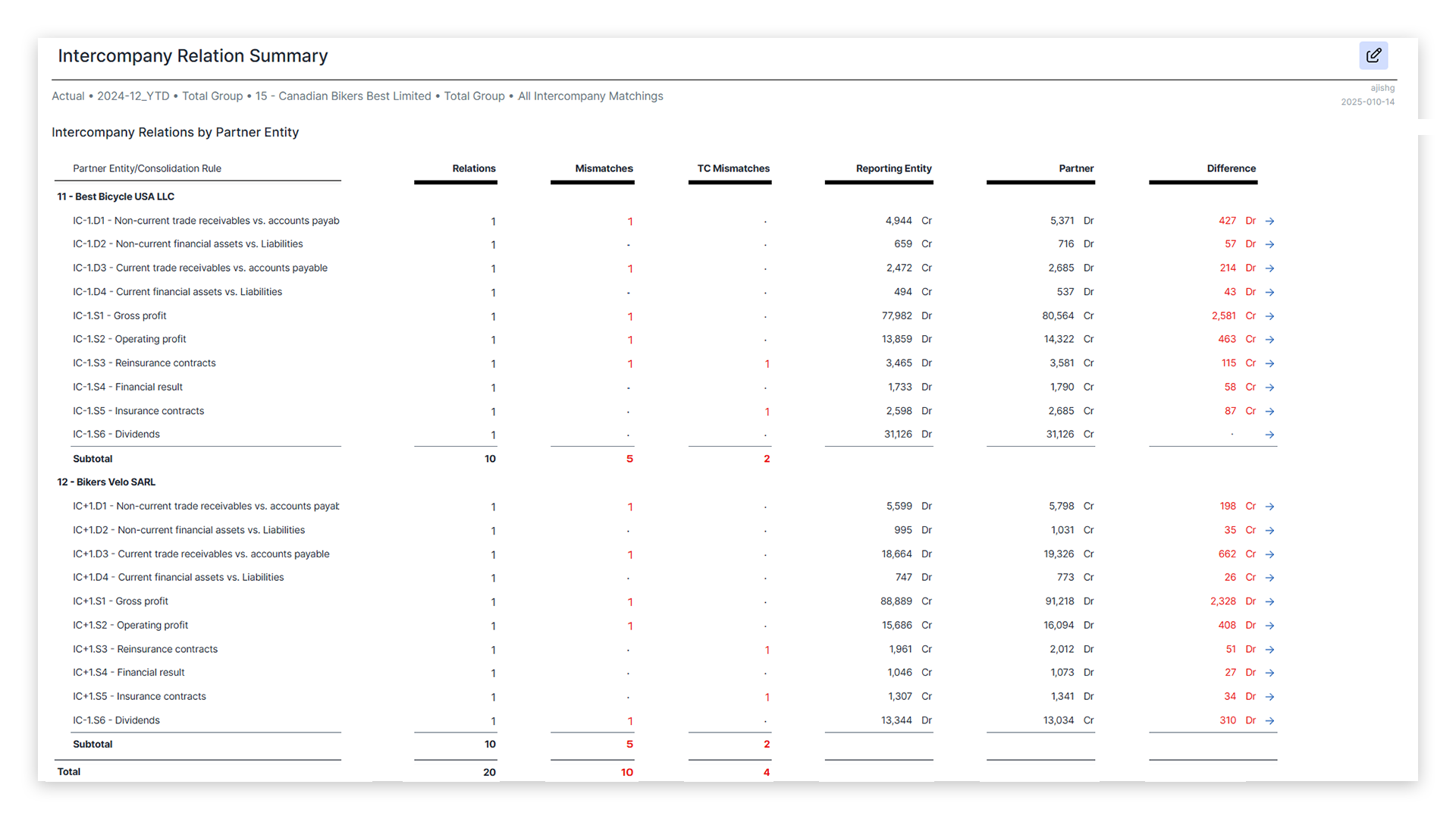

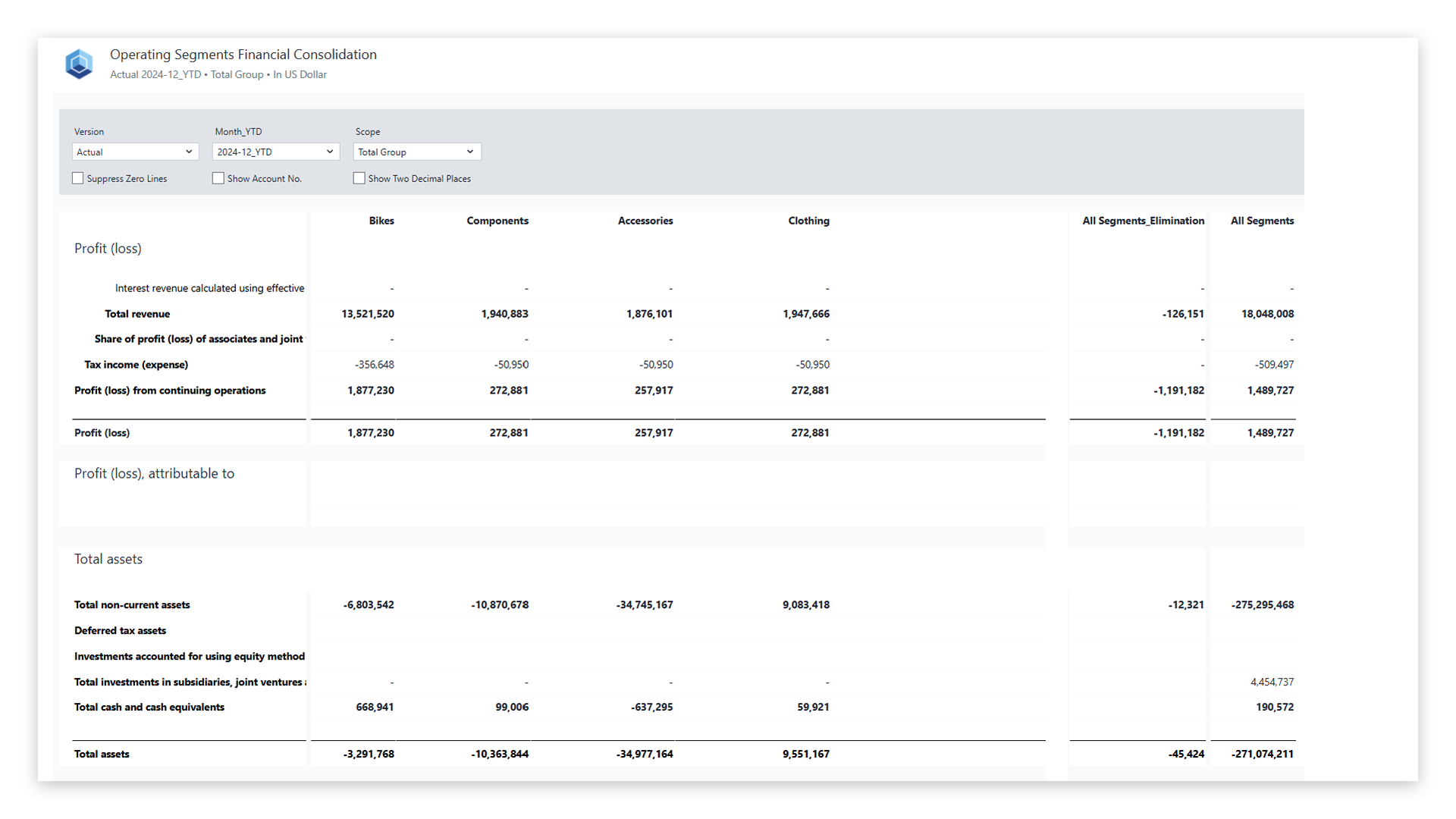

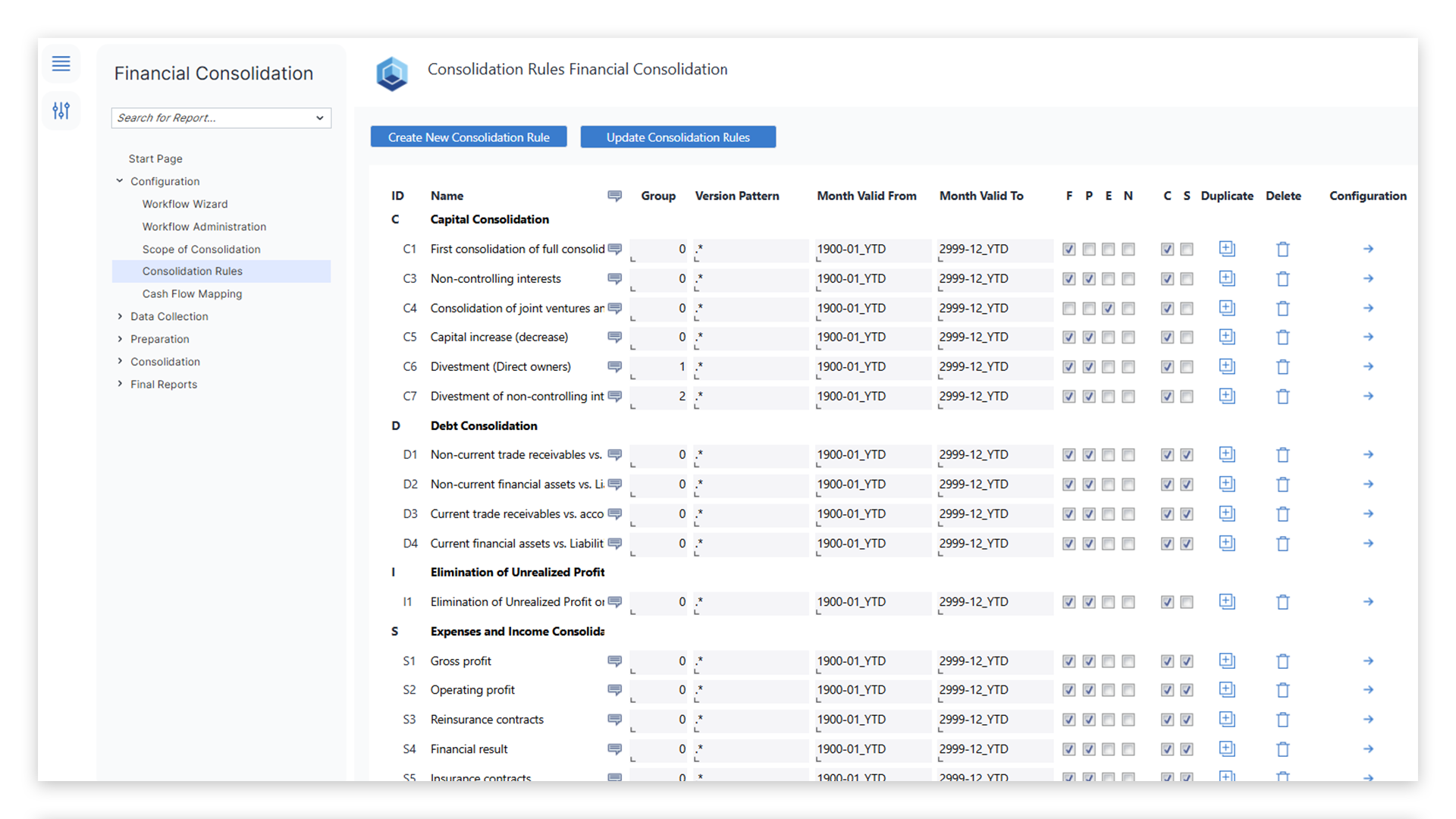

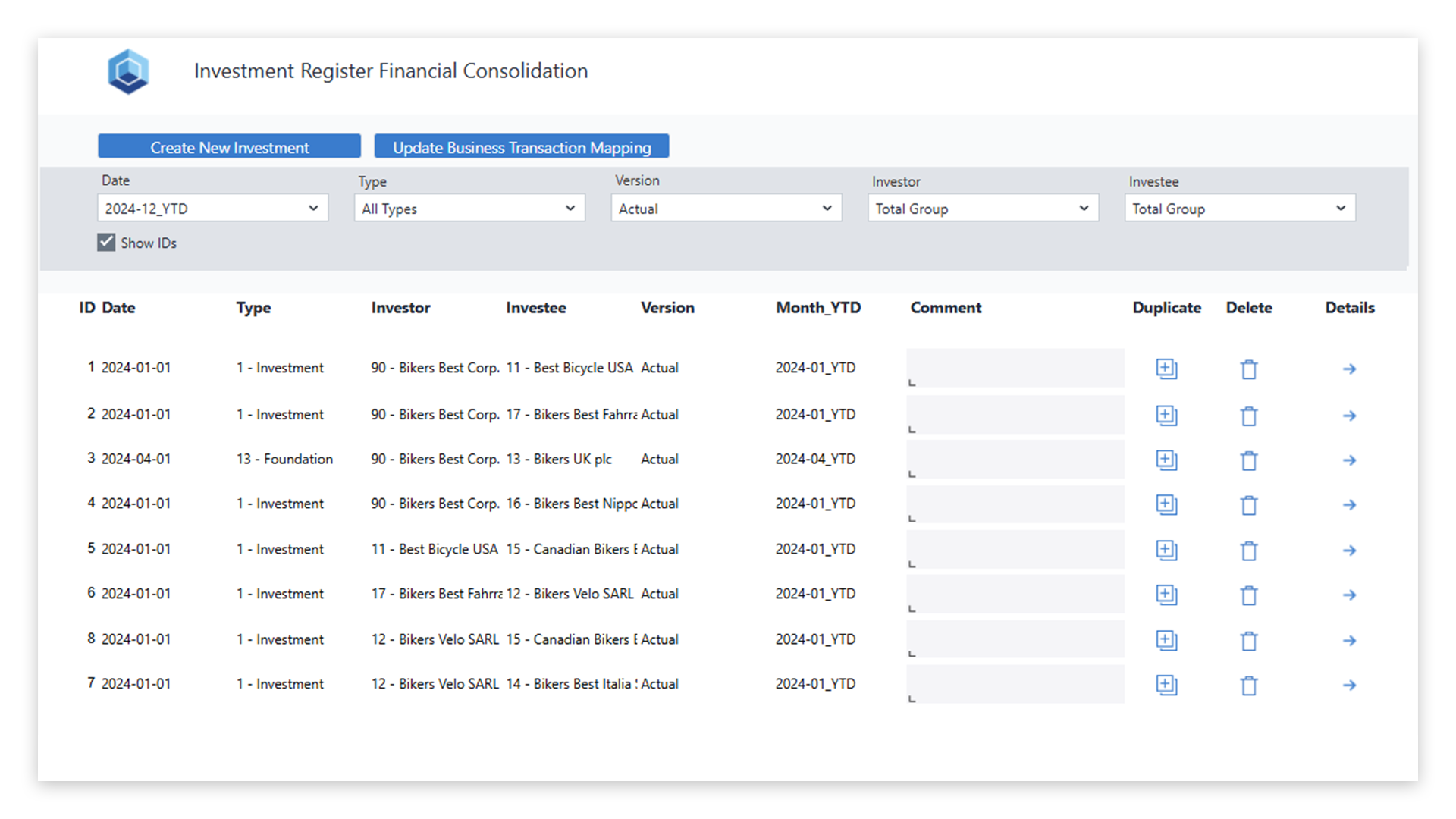

Jedox Financial Consolidation comes with preconfigured logic, rules, and reports that accelerate setup and ensure compliance. Finance teams streamline group and subgroup consolidation, intercompany eliminations (e.g., capital-, debt-, expense- and income consolidation), as well as segment reporting. It supports multiple accounting standards so companies can meet regulatory requirements while maintaining consistency and accuracy across legal entities. Supported standards include: IFRS, US GAAP, German GAAP (HGB), and other local GAAP standards.

With automated intercompany eliminations, intelligent validations, and role-based workflows, Finance teams gain full transparency and auditability. The familiar Excel-integrated interface shortens adoption time and drives user acceptance.

Drive strategic value and insight through integration with a comprehensive planning process

Jedox financial consolidation goes beyond compliance. By leveraging the Jedox platform, it unites consolidation and planning within a single environment—creating the foundation for integrated business planning and strategic forecasting. Finance teams can model best- and worst-case scenarios, visualize real-time KPIs, and analyze performance with full drill-down capability. AI-powered forecasting enhances accuracy, enabling smarter, forward-looking decision-making.

Implementation made simple

The financial consolidation solution seamlessly integrates with other Jedox solutions—forming your digital business twin for unified planning and management. Together with Jedox’s expert team and global partner network, you’ll receive end-to-end support, from configuration to go-live and beyond.

Trust your consolidation process—and the underlying platform

The Jedox financial consolidation solution is recognized in the Gartner® Magic Quadrant™ for Financial Close and Consolidation and is a Leader in the Gartner® Magic Quadrant™ for Financial Planning Software. Jedox Financial Consolidation Solution achieved PS IDW 880 certification through an audit conducted by KPMG.

Built on Microsoft Azure, Jedox ensures enterprise-grade data security, privacy, and compliance. Your data remains fully protected in dedicated, isolated environments—giving Finance leaders peace of mind.