Rolling Forecasts: A Beginner’s Guide to Continuous Performance Management

Planning is paramount to success. This requires knowing past performance and the current state to effectively plan for the future. But what happens when things don’t turn out as you planned? Forecasting is an important business tool that helps you to be aware of potential future developments and trends. In this beginner’s guide to continuous performance management, we’ll show you the who, what, and why of rolling forecasts, when they make sense, and how you can implement them successfully for your organization.

Why forecasting is crucial for organizations

Forecasts are a key tool used in finance and sales, and common in medium-sized and large organizations. When many departments and/or branches are networked, maintaining a certain level of complexity becomes a challenge. The purpose of forecasting is to identify expected deviations from the plan at an early stage so that the organization can react accordingly. For example by quickly adjusting the budget.

When and how often forecasting is carried out, and what data is used for it, varies from organization to organization. Similarities can be found within specific industries or markets. Forecasts can be made both regularly and irregularly – i.e. “ad-hoc.” It is important to note that forecasts are not to be used as a prediction tool, but rather as an indication of necessary changes to achieve operational and strategic goals.

For this purpose, forecasts can be created in different departments of the business, for example as sales forecasts or financial forecasts, as well as based on different underlying values. Plan values can be compared with forecast values or actual values with forecast values as a basis for comparison.

For the forecast itself, you can include different types of data. Certain value drivers, such as prices or quantities, can be considered as well as non-financial data (e.g. effects of new competitors on the market, weather etc). In general, however, it is recommended to keep the various datasets for the forecast precise but manageable. This reduces the effort and expense involved, and at the same time optimizes your use of the tool.

The key element to all forecasts is that they are created for a specified period of time. The period used depends on the industry and the current or standard market volatility in that industry.

What are rolling forecasts?

Rolling forecasts are a specific type of forecasting that use existing data to help predict aspects of business performance throughout the year. In this process, new forecasts are regularly prepared for a specific period on an ongoing basis. They are most often used in finance but can be equally helpful in sales and other functions.

Rolling forecasts as a tool for finance

Rolling forecasts are used periodically throughout the fiscal year. They either serve as a supplement to the fiscal year forecast, budget and other plans or completely replace the annual forecast. For rolling forecasts, an interval is defined at which you create and review forecasts. Since there isn’t a universally standard interval, it must be evaluated individually for each organization.

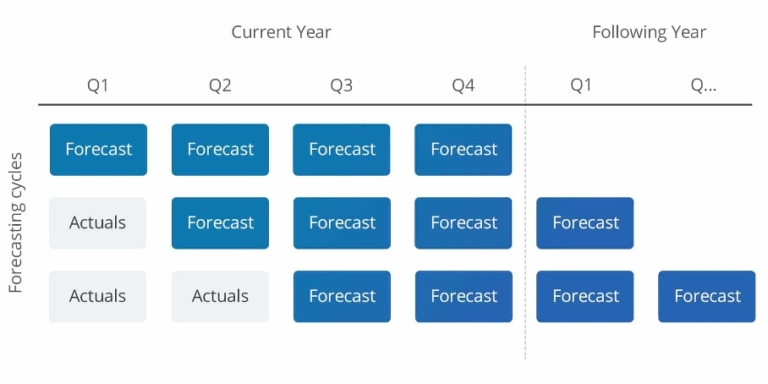

The graphic above shows an example of a quarterly interval with a forecasting horizon of 12 months. However, a weekly or monthly interval is equally possible – the same applies to the forecast horizon. Figuratively speaking, this is the size of the “roll” moving ahead, which always remains the same. This is because with each interval a new forecast is added to the end of the existing 12-month forecast. To put it differently: the existing 12-month forecast is extended.

It is important to note that forecasting this way is more accurate. It becomes increasingly time-consuming the more often it takes place (the interval) and becomes less precise, the broader the forecast horizon. However, since we understand forecasts as a tool for finance, a higher degree of inaccuracy can be counterproductive.

Rolling forecasts are useful as a management tool because, unlike annual plans, you always look at the same time horizon (e.g. 12 months) – regardless of the current fiscal year. Thus, the problem of traditional plans, where only a few months or even just one month of planning data is available towards the end of the year, is zeroed out. In addition, forecast values are more up-to-date and more useful for making informed decisions. This helps to keep your organization on track through better insight and better decisions.

The advantages and disadvantages of rolling forecasts

Regularly considering new data and factors helps to quickly identify probable deviations from the plan and to counteract these by taking appropriate measures. With the introduction of rolling forecasts, you also ensure a look beyond the current fiscal year by continually supplementing and adjusting plans. The approach thus also takes into account the fact that business planning for maximum value creation should be a continuous process.

There are two key reasons for this:

- Markets are increasingly volatile due to globalization and the increased internationalization of financial capital. Planning that is not seen as a process but as a static task that has to be brushed off once a year is no longer sufficient.

- Concrete plans are generally all the more valuable the more up to date they are. This also means that new factors are taken into account during the course of the year if necessary, thus preventing plans from deviating so far from reality that they no longer provide any value.

So, rolling forecasts are a great tool, right?

There are still a few things to consider. It is possible for rolling forecasts to replace annual forecasts, but in reality, they are more likely to be used as a supplement to existing enterprise performance management tools. One reason for this is that in most cases, plans are still prepared on a fiscal year basis, which has been the standard for a long time. This means that organizations have to keep a focus on their annual financial statements. So, if you also use rolling forecasts, this means additional work, the scope of which needs to be carefully monitored. Therefore, it is also important to include less detailed information and only the most important KPIs in your rolling forecasts. Ideally less detail than in a larger and more complex year-end forecast. The interval and horizon for the rolling forecasts should be carefully planned to avoid unnecessary work and keep the forecasts as accurate as possible.

When do rolling forecasts make sense?

Market volatility is increasing again. Traditionally volatile sectors have been even more unpredictable, but even comparatively stable sectors are showing more volatility, irregularity, and uncertainty. Solid planning is even more important to manage these uncertainties. Rolling forecasts can be an extremely useful tool to help your organization navigate these issues with increased clarity and focus.

The following rule of thumb is a useful guide: The higher the market volatility in a particular industry, the shorter the interval for creating, reviewing, and adjusting rolling forecasts should be. Conversely, if market volatility is low, a longer interval is sufficient.

If you notice that actual and planned data in your organization or department regularly deviate, it is worth considering the introduction of rolling forecasts to better understand and manage the deviations.

Why it’s recommended to use a specialized solution

As we mentioned above, rolling forecasts often do not replace the forecasts already in use in many organizations. Rather, they serve as a supplement to an existing approach. In practice, this means one thing above all: additional work for Finance, who are already very busy. Especially if their tasks are only supported by Excel on the software side.

To implement continuous performance management with rolling forecasting, a specialized forecasting software solution is highly recommended. Having timely forecasts at hand is great. If you can’t act on their results, however, all the work that goes into them is wasted. Automating processes and unifying them to free up time for analysis and recommendations of action must come with the agile approach.

5 Tips for implementing rolling forecasts

If you’re confident rolling forecasts would be a useful tool to add to your organization’s existing FP&A toolbox, check out our five tips for a successful implementation:

1. Communication is key

The first and most important point is to involve all stakeholders in the communication process. Be sure to provide explanations on why you think rolling forecasting would be valuable for your organization.

It may seem obvious; but in reality, projects often fail due to lack of communication with and between stakeholders. If stakeholders do not clearly understand the value for the organization, the success of implementing rolling forecasts may be at risk. This applies to management as well as to departments and their managers.

For example, you present management with points such as greater risk awareness and the identification of new opportunities through more precise planning figures. Department heads are pleased about greater flexibility, for example, if the budget is adjusted during the year based on new findings, because current actuals suggest a higher level of engagement. In this way you avoid shadow budgets altogether.

2. Careful planning

As we pointed out rolling forecasts can either replace or supplement other forecasts, such as the year-end forecast. There is no universally perfect answer as to which way is the right one for your organization. Carefully exploring how the options can best meet your organizational needs is key.

The implementation – whether as a replacement or a supplement to existing processes – can then be planned and executed. A replacement of your existing forecast process requires more persuasion and initially involves more planning than adding rolling forecasts as a supplement. It should also be kept in mind that the legal framework and guidelines for financial statements, etc. remains the same. For that reason a step-by-step and parallel implementation is strongly recommended when replacing existing processes, in order to identify and address any issues early.

A step-by-step implementation is also beneficial when using rolling forecasts as a supplement. For example, you can include only a few key figures and departments at first and then gradually expand the use of rolling forecasts. Continuously monitoring will help keep things in check for the drivers used and the interval and forecasting horizon.

3. Coordinate and implement new processes

If you forecast during the year, this also requires regularly updated actuals in your database. Simple and obvious. It also means that data collection processes will change. It is no longer sufficient to collect and evaluate data once a year. The teams in various departments have to provide data more frequently – depending on the interval selected for the rolling forecasts. Here, too, open communication is required to promote support and to involve departments to participate in the process of selecting suitable KPIs.

Here, too, much can be automated: This keeps the effort for stakeholders manageable. Software solutions for FP&A offer convenient options for this that don’t heavily rely on IT support, if any at all.

4. Keep performance targets and rolling forecasts separate

To ensure maximum benefit from rolling forecasts for your organization, the data included and the forecasts themselves should not be tied to performance targets. The forecasts are much more useful if they are based on accurate, consistent data. However, if forecasts are linked to performance targets, the probability of whitewashing increases. This means that the data loses precision and the forecast becomes less meaningful.

5. Using integrated and unified planning processes

Sure, rolling forecasts can be implemented with using Excel. But any professional who plans solely with Excel knows that planning processes are already time-consuming. A further FP&A instrument such as rolling forecasts adds additional strain. To circumvent this issue, a modern technology solution with a central database to ensure data is consistent throughout is recommended. An additional advantage is that many of the tasks involved can be automated and tedious merging and reviewing spreadsheets can be eliminated. With a central system in which all departmental managers enter their figures independently, you easily declutter your daily processes as a finance professional and have time to focus on being a strategic partner across the organization.

Summary

- Keeping communications consistent throughout of the entire process of introducing rolling forecasts is a top priority. Involve the various stakeholders at every step.

- Plan the implementation carefully: How large should the interval be, and what is the horizon? What is the purpose of the rolling forecast and what data do you need for it? A comprehensive picture of the various circumstances and requirements is essential.

- When coordinating new processes, again, communication is extremely important. Avoid presenting your stakeholders with fulfilled facts!

- In order to be able to utilize the full potential of rolling forecasts, the data basis must be as accurate as possible. Therefore, make sure that it isn’t tied to performance targets.

- And, finally: the implementation is much easier and execution much faster if your business planning is already based on a software solution that serves as a central platform for all departments and processes. Plan collaboratively and integrated across all departments to optimize value creation.